Grant-based development programs have long been criticized for creating unsustainable funding streams that drain resources without delivering lasting value.

Even though the pitfalls of grant-based programs have been widely observed in the traditional development funding programs, Web3 organizations are facing similar outcomes where grant-based funding initiatives have not generated the intended result.

The result is billions of USD allocated into grant programs each year by Web3 organizations without proving they actually achieve desired outcomes. Beyond the depletion of their treasury, such grant programs, in fact, create negative incentives for the participants involved:

- Web3 Organizations seek the adoption of their token and long-term commitment from builders by allocating large amounts of capital via their own token into grant programs. This creates predictable sell pressure that continuously leaks value from the token without bringing predictable adoption, token holding, or long-term commitment from builders. Instead, the organizations who compete with each other to attract builders and communities through grant programs lead to “pay-to-play” competition among chains and make grant farming, in which projects build on ecosystems that offer the largest incentives and successively repeat the process through other chains, a permanent operational fixture for projects building in Web3.

- Projects want to benefit from the advantages of tokenization, but the costs and complexities involved are often prohibitive. Instead, if they do not meet the criteria for VC investment or do not choose to pursue that path, they can slip into a cycle of grant chasing to stay funded.

- Communities want access to a stake in Web3 projects, but most do not have opportunities to meaningfully participate in a project’s growth. Web3 communities are constricted to hoping for an airdrop and speculating on the vast universe of unvetted tokens, where it is often impossible to tell the scams from those with real potential for future value.

These examples underscore the challenges in grant-based development and highlight the need for models that promote self-sufficiency and circular funding, particularly as Web3 organizations seek sustainable growth. Every organization would prefer to support their ecosystem growth in a way that generates positive value for all the stakeholders involved but lacks the necessary design space to realize such circular funding mechanisms on blockchain. (1)

To address this grant funding trap, the q/acc protocol emerged as an alternative path to evolve the web3 grant mechanisms: one that incorporates tokenization and democratization of ownership and access.

About the q/acc Protocol

Quadratic Accelerator (q/acc) is a novel tokenization protocol that allows organizations to direct capital toward incubating token economies for projects within their ecosystem while generating meaningful community participation and positive value for their tokens.

The protocol is designed by Justice Conder, Tamara Helenius, Griff Green, incubated at Giveth, and is built on Polygon. It is powered by the teams and talent behind Commons Stack, General Magic, and Inverter Network.

Introducing the Mechanism

The q/acc protocol combines the unique capabilities of Primary Issuance Markets and Quadratic Funding mechanisms to create an ecosystem funding framework that aligns incentives of all the involved stakeholders.

At a high level, the q/acc protocol is designed to:

- Jumpstart new token economies which are likely to be worth many times more than the initial grant value.

- Direct grant funding into bootstrapping token economies’ Primary Issuance Markets and liquidity pools on decentralized exchanges.

- Drive TVL and ecosystem growth for the funding organization while eliminating the token sell pressure experienced with traditional grant programs.

- Engage communities to support these projects and become token holders via meaningful contribution, rather than as donors or hopeful recipients of airdrops.

- Guide projects through tokenization and automate the growth of their secondary market liquidity.

- Provide projects with a clear path to mature their market liquidity and grow capital.

- Align long-term incentives with their projects by pairing together each other’s tokens for liquidity.

How: the q/acc Mechanism Walkthrough

The q/acc protocol works across multiple phases of launching and participating in a token economy:

1. Projects Launch Their Token Economies:

- $POL tokens are allocated for initialization of Project’s PIMs

- Primary Issuance Market (PIM) parameters use preset q/acc protocol configuration for their token, with $POL as the reserve asset.

- Project's multi-sig wallet receives whitelist access to the PIM.

- The Project Team mints their initial token allocation through the PIM.

- Minted tokens are vested to the project’s team address according to the cliff and vesting schedule set by the q/acc program.

- The initialization creates the first price floor for the team’s token lock duration.

2. Early Supporters Become the Initial Token Community:

- Project creates a whitelist of early supporters, and the whitelisted addresses receive access to participate in the early minting round.

- These supporters send their $POL tokens to the Funding Pot to participate in the early minting round.

- Every 24 hours, the Funding Pot; collects all $POL deposits from that period, mints project tokens from the PIM in one batch and distributes the tokens to the participants proportional to their $POL contribution.

- All distributed tokens are locked according to the set cliff and vesting period to ensure long-term alignment.

- This batch minting ensures everyone in the same 24-hour period gets the same token price.

- The early minting round increases the price floor for the token throughout the lock duration.

3. The q/acc Round Runs with Open Community Participation:

- PIM removes whitelist restrictions.

- The process works similarly to the early supporters phase, but now anyone can participate via the Funding Pot.

- At the end of the round, the PIM access is closed to the community and the quadratic matching pool address is whitelisted.

- The quadratic matching pool allocates $POL to each project according to the quadratic matching formula. The quadratic matching formula calculates matching funds based on the number of unique contributors rather than solely on the total amount raised, thereby giving more weight to projects with broader grassroots support.

- Half of the matched funds from the pool are used to mint additional project tokens, and the other half to provide liquidity on decentralized exchanges that pairs the minted project tokens with the $POL token.

4. The Token Economy is Live with Bootstrapped PIM and Secondary Market Liquidity :

- The project whitelists the market making bot to dynamically mint and redeem tokens depending on the price volatility on the secondary markets.

- Over time, as token prices in the liquidity pools on secondary markets diverge from the mint and redemption prices on the PIM, the market making bot maintains price equivalency between the PIM and the secondary markets.

- The profits that the bot makes from the price differences flow to the project or, alternatively, they can be directed toward growing the liquidity pool on the secondary markets.

5. Projects Graduate off of their PIM :

- As the projects meet set growth milestones, it enters a graduation phase and transitions away from the PIM.

- The project receives all the funds in the reserve pool upon completion of the graduation phase. This injection of capital arrives at the same time as their token economy has matured sufficiently enough to turn off the PIM.

- Upon graduation, the project may transition to a dynamic issuance model.

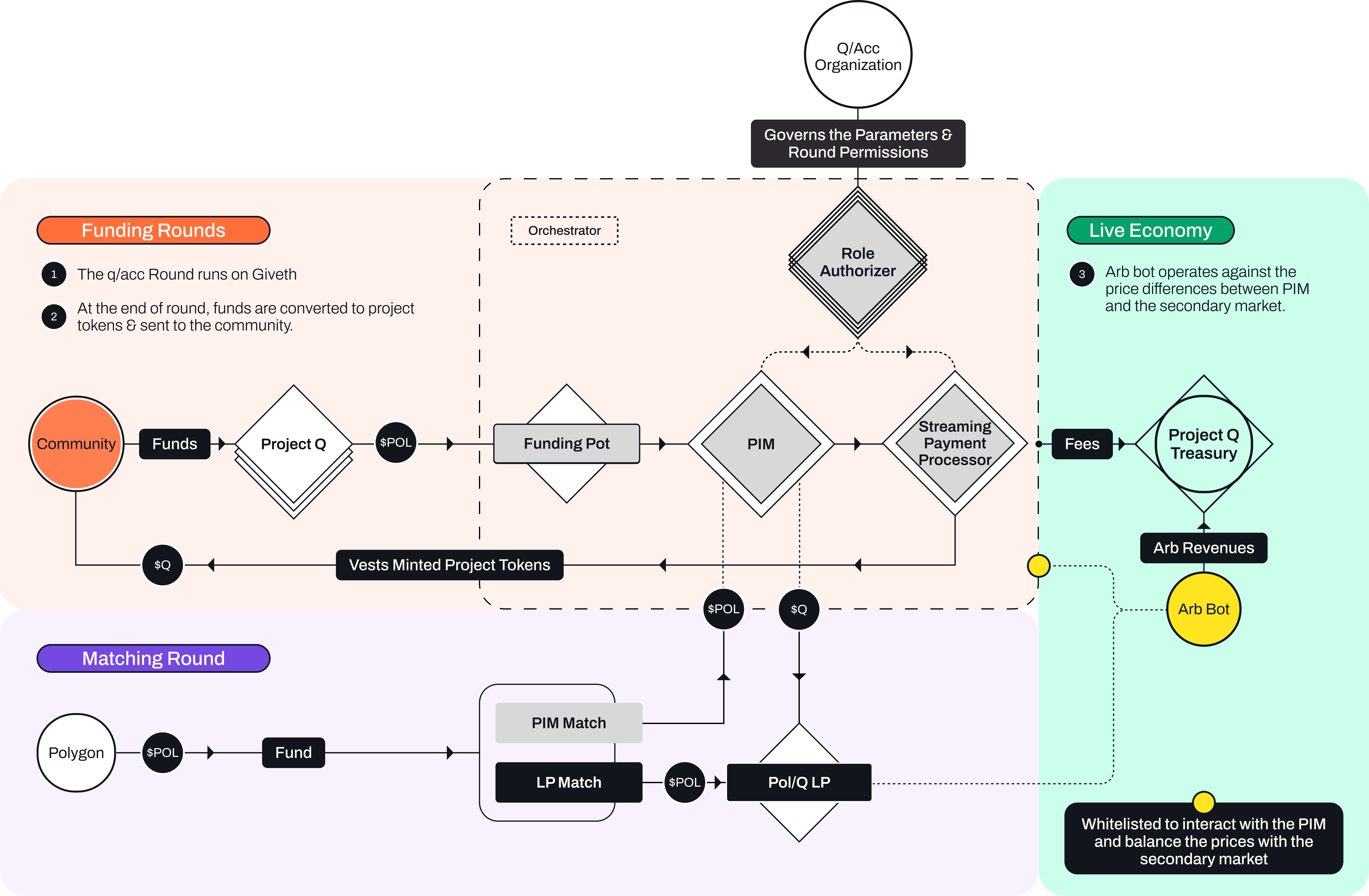

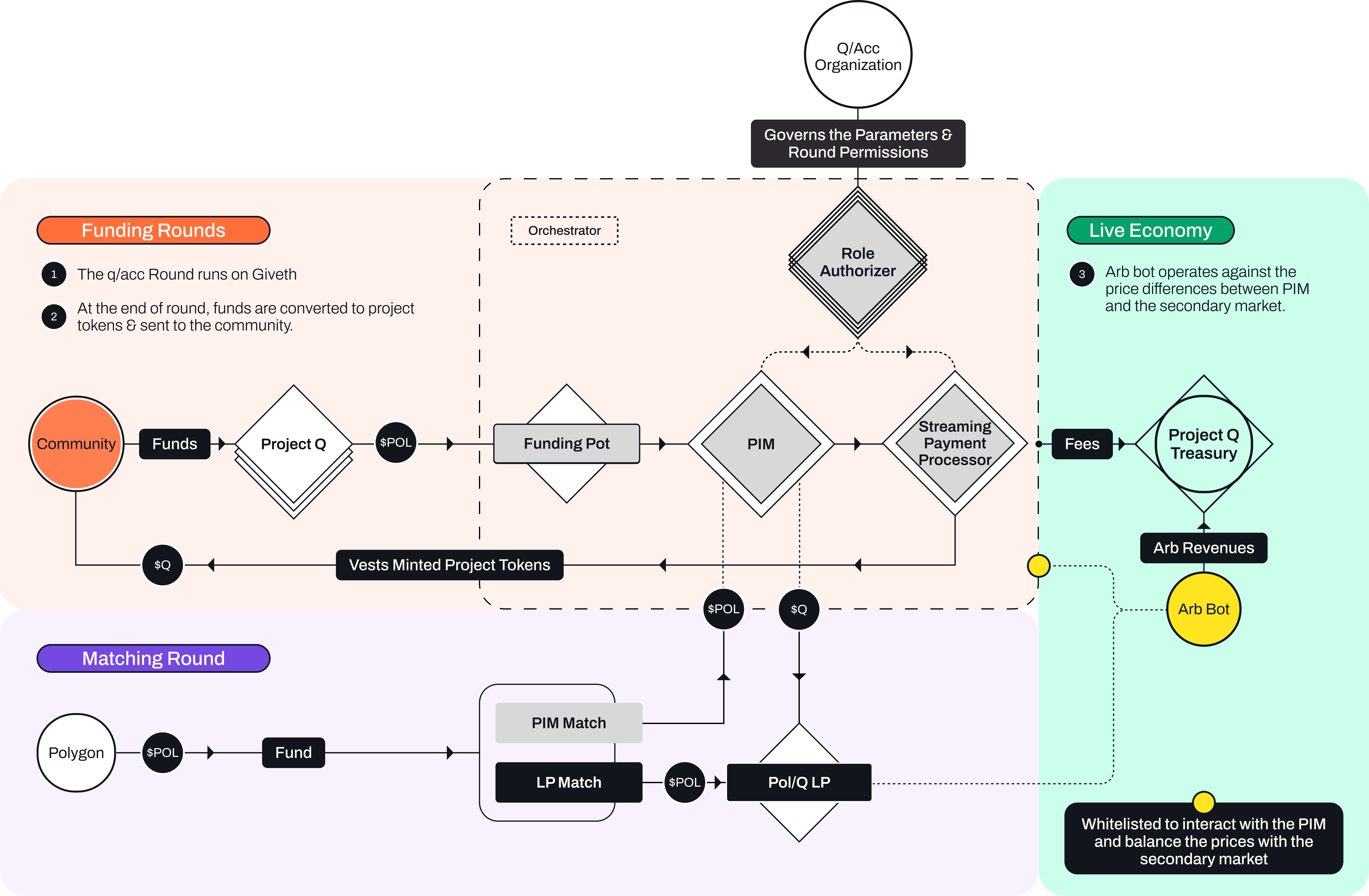

On the blockchain, the projects’ token economies on the q/acc program operate via Inverter protocol as follows:

Role Based Authorizer

- Manages access control for the PIM

- Facilitates whitelisting of the buy and sell functions for various stakeholders across different phases

Augmented Bonding Curve Primary Issuance Market

- Facilitates algorithmic minting and redemption of tokens with dynamic pricing.

- Doesn’t require pre-existing liquidity to launch a token economy.

- Applies minting and redemption fees, generating a perpetual revenue stream for the projects.

Funding Pot

- Aggregates deposits during a round and performs periodic batch buys with them to provide equal pricing.

Streaming Payment Processor

- Pays out the minted tokens to the participants based on a vesting schedule and cliff.

Moreover, Inverter’s protocol architecture ensures customizability and adaptability for the Quadratic Accelerator Protocol to evolve over time. The q/acc protocol can easily integrate new technologies and modify PIM mechanisms to iterate on its protocol design and efficiency based, such as:

- The vested tokens unlock rules can be subject to set KPIs, rather than time to align incentives with desired outcomes.

- The PIM mechanism can be expanded to utilize the idle reserves in DeFi strategies or support yield bearing assets, addressing the capital inefficiency problem with the PIM reserves.

Benefits of Quadratic Accelerator Protocol Design

The q/acc protocol addresses inefficiencies and chronic stakeholder misalignments in current ecosystem funding models, and introduces a circular and positive-sum approach in their place that benefits all stakeholders:

For Web3 organizations who want to bootstrap and support projects in their ecosystem, q/acc ensures that funded projects remain engaged and committed to the ecosystem long-term. It creates a circular economy between the ecosystem stakeholders and project tokens, fosters sustainable growth for projects who are building for the long-term, maximizes the value of capital spent for grants, and adds new utility for the organization’s token by making them the reserve asset for their ecosystem.

By design, q/acc enables grant capital to increase demand for the sponsoring organization’s token. The majority of grant capital allocated by the organization stays in their token as a reserve locked in the projects’ PIMs or as a liquidity pair in the secondary markets.

For communities, q/acc provides a fair way for a project’s supporters to participate in supporting projects early and become stakeholders. This direct involvement engages community members to meaningfully contribute to and benefit from the success of projects they support.

For projects, q/acc simplifies the path to launching a token economy. It offers dynamic supply discovery, bootstrapped liquidity, ongoing revenue streams, and a growth path that reduces dependency on traditional funding sources and allows projects to retain more control over their development and token distribution.

What's Next

The Quadratic Accelerator, a startup that is implementing the q/acc protocol, is currently running its first season. The q/acc protocol is built on Polygon zkEVM and the first cohort of Web3 startups have already launched their PIMs.

The eight projects were selected from hundreds of applications. They span web3 categories as diverse as DeFi protocols, AI, governance, gaming, payment solutions, NFTs, and music and entertainment. You can learn more about the selected projects by visiting this announcement post from the Quadratic Accelerator.

To participate in this unique opportunity to support one or more of these projects at the earliest stage of their token economy, follow the accelerator on X to be the first to know when the q/acc round starts this Fall. You can also visit their site here.

Be in the Loop

As we embark on this journey together with the Quadratic Accelerator, here are some great ways to stay connected and informed:

Learn More about the Quadratic Accelerator Protocol

The q/acc Paper

Follow Quadratic Accelerator

Quadratic Accelerator on X

Learn More about Inverter Network

Vision Paper | Protocol Architecture

Follow Inverter Network

LinkedIn | Twitter | Github

If you have a token economy in mind that you would like to build using Inverter, you can reach out to us by filling out this 1-minute typeform!

(1) Despite the clear need for better solutions, there's been little experimentation in sustainable funding mechanisms, with only a handful of initiatives like Optimism's Retroactive Public Goods Funding and Stellar's Neurum governance attempting to innovate in this design space.